Black Friday has evolved from a single day of doorbuster sales into a global shopping phenomenon spanning both online and offline channels. Each year brings new record-breaking statistics and emerging consumer trends, and 2025 was no exception.

In this report, we’ll dive into the latest Black Friday statistics, from soaring spending figures and shifting consumer behaviors to marketing trends and regional insights, and look ahead at what to expect for Black Friday 2025.

Record Spending and Growth in Black Friday Sales

Black Friday 2024 shattered previous records, underscoring the continued growth (albeit at a moderating pace) of holiday shopping. Consumers spent more and shopped in greater numbers than ever:

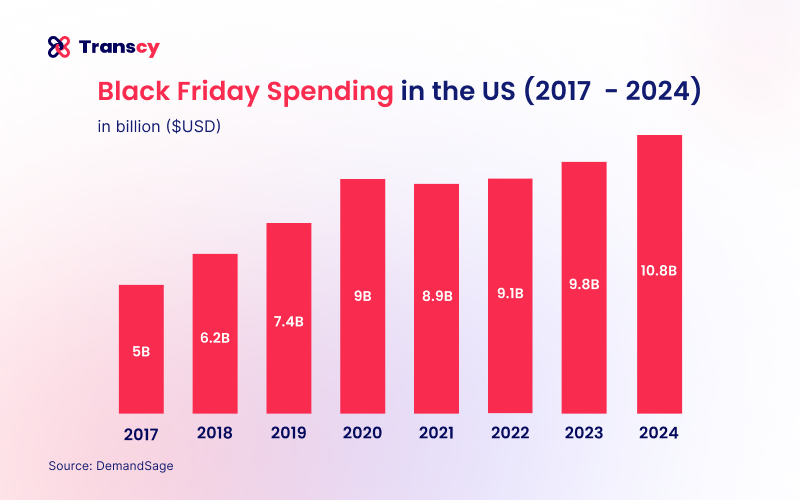

- U.S. Online Sales Reached $10.8 Billion on Black Friday 2024, a 10.2% increase over 2023. (Source: NPR’s BFCM record spending)

- The 24-hour Black Friday period saw an estimated $74.4 billion in online sales worldwide, up about 5% from the prior year. (Source: Salesforce’s 2024 Cyber Week Shopping Insights Report)

- An estimated 87.3 million U.S. consumers shopped online on Black Friday 2024, outnumbering the 81.7 million who shopped in physical stores. (Source: NRF’s Thanksgiving Weekend Retail Data Release)

- The five-day Thanksgiving weekend attracted roughly 197 million U.S. shoppers in 2024, nearly on par with the 200 million who shopped in 2023. (Source: NRF’s Thanksgiving Weekend Retail Data Release)

- Black Friday sales have nearly doubled since 2017 (+96%), from $5.0 billion in 2017 to $10.8 billion in 2024. (Source: Adobe’s 2025 Holiday Shopping Forecast)

- Total holiday season retail spending (Nov–Dec) hit a new high in 2024, reaching $241.1 billion, up 8.6% YoY. (Source: Adobe’s Post-Holiday 2024 Sales Analysis)

Key takeaways for businesses: Capitalizing on Spending Growth

- Ensure your e-commerce infrastructure is ready for record traffic and sales volumes. With online spending hitting new highs each year, website performance (page load, checkout uptime) on Black Friday is mission-critical.

- Maintain sufficient inventory levels and consider demand forecasting for popular products. As overall spending grows, top-selling items can sell out fast, so use last year’s data to anticipate 2025 demand.

- Plan for multi-channel shoppers. Millions still shop in-store, so coordinate online and in-person promotions. Services like buy online, pick up in store (BOPIS), or store-only doorbusters can help capture both audiences.

- Leverage the full holiday season. With slightly slower growth forecasted, it’s important to maximize not just Black Friday but the weeks around it (early November sales, Cyber Monday, etc.) to hit your season targets.

Shifting Consumer Behavior and Shopping Trends

It’s not just how much consumers spend on Black Friday that’s changing. It’s how and why they shop that’s evolving. Recent statistics reveal several notable consumer behavior trends shaping Black Friday 2024 and beyond:

Buy Now, Pay Later (BNPL) on the Rise

Shoppers have increasingly embraced BNPL financing for holiday purchases.

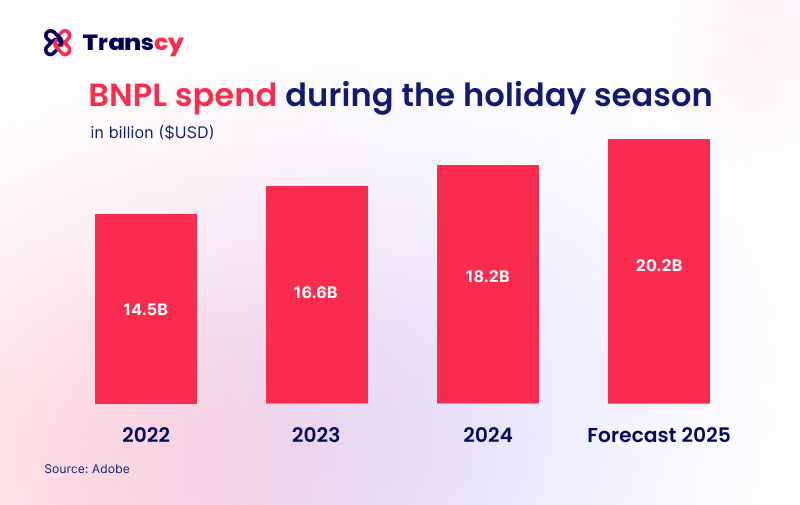

- In 2024, U.S. consumers spent $686 million via BNPL on Black Friday alone (Source: PCMag’s 2024 Black Friday Online Spending News), contributing to about $18.2 billion in BNPL spending over the full season. (Source: Adobe’s 2025 Holiday Shopping Forecast)

- On Cyber Monday alone, nearly $991 million of online sales were paid for using BNPL plans. (Source: Adobe’s 2025 Holiday Shopping Forecast)

- A large chunk of BNPL transactions happened on mobile devices (around 75% of BNPL purchases were on mobile in 2024), indicating younger, mobile-savvy shoppers driving this trend. (Source: Printful’s 2024 Black Friday Statistics Summary)

Self-Gifting and the “Treat Yourself” Mentality

Black Friday isn’t just about gifting others. It’s also a time people shop for themselves.

- Nearly two-thirds of Black Friday/Cyber Monday shoppers (64%) say they’ll buy items for themselves or their household during the sales. (Source: Modern Retail’s Report on Self-Gifting Trends)

- This self-gift trend is especially strong among younger adults. One survey found 73% of Millennials and 68% of Gen Z planned to buy themselves a holiday treat. (Source: Salsify’s 2024 Holiday Shopping Report)

Eco-Friendly Choices Matter

Consumers are showing a growing preference for sustainability, even amid the spending frenzy.

- Over 51% of shoppers opted for eco-friendly (“climate-smart” or carbon-neutral) delivery options at checkout when given the choice. (Source: Ingrid’s 2024 Black Friday Insights Report)

- Additionally, surveys indicate that more than half of Gen Z and Millennials prioritize sustainable products/packaging on Black Friday. (Source: Deloitte’s 2024 Holiday Retail Survey)

Value-Conscious and Cautious

High inflation and economic uncertainty in 2024 made shoppers more price-sensitive.

- Nearly 3 in 10 consumers (29%) planned to spend less in the 2024 holiday season compared to 2023, citing factors like rising living costs. (Source: PwC’s 2025 Holiday Outlook)

- Many exhibited frugal behaviors: surveys found 40%+ of consumers showing multiple signs of cost-cutting (budgeting carefully, seeking deals, etc.). (Source: Deloitte’s 2024 Holiday Retail Survey)

- Shoppers increasingly compare prices and hunt for the best value: over half now prepare wish lists in advance and “cyber window-shop” online to find the best deals. (Source: Impact.com’s 2023 Cyber Week Consumer Trends Analysis)

Early Shopping & “Black November”

Retailers’ early-bird October sales and November “Black Friday Week” promos have trained shoppers to seek deals well before Thanksgiving weekend.

- Roughly two-thirds of consumers had already started shopping before Black Friday 2024. Some as early as October or even in the summer. (Source: McKinsey’s 2025 Holiday Shopping Trends Podcast)

- In 2024, 38% of consumers participated in early October sales events (up from 24% in 2023), and over 60% of consumers were hunting for deals by early November. (Source: Deloitte’s 2024 Holiday Retail Survey)

Key takeaways for businesses: Responding to Consumer Trends

- Offer flexible payment options: Integrating BNPL at checkout can boost conversion, especially for younger shoppers looking to spread payments. Highlight this option prominently.

- Cater to the Self-Gifter: Don’t market only to gift-givers; speak to those buying for themselves. Consider messaging like “treat yourself” or special self-gift promos to capitalize on the ~66% of shoppers in self-buying mode. (Source: Gallup’s 2023 Holiday Shopping Trends Survey)

- Emphasize value and savings: Given the high level of cost-consciousness, make discounts very clear. Use comparisons (e.g., “Was $100, now $50”) and stress total savings. Ensure you’re competitively priced since customers are actively comparison shopping.

- Highlight Sustainability: A growing segment, especially Gen Z and millennials, seeks eco-friendly products. Showcase your sustainable practices or green product lines to attract the 50%+ of young consumers who prioritize them. (Source: Deloitte’s 2023 Holiday Retail Survey)

- Start Promotions Early: Given that many shoppers start deal-hunting well before Black Friday, plan early-bird sales or previews in early November. Capturing those early shoppers can secure sales that might otherwise go to competitors.

Black Friday Shopper Demographics

Black Friday may be a nationwide event, but not all shoppers behave the same. Demographic insights show which groups are most engaged and how their Black Friday habits differ:

By Generation

Younger consumers lead the charge on Black Friday.

- An impressive 84% of Gen Z consumers believe Black Friday offers good value, the highest of any age group. (Source: Finder’s Black Friday Statistics 2024)

- Gen Z and Millennials have the highest participation rates, with surveys showing that 79% of them planned to shop during Thanksgiving week 2024. (Source: Deloitte’s 2024 Holiday Retail Survey)

- Millennials and Gen Z are not only more likely to shop but also tend to spend more freely on Black Friday. Notably, 60% of Gen Z shoppers later regretted some Black Friday purchases. (Source: Finder’s Black Friday Statistics 2024)

- Older generations (Gen X, Boomers) also participate, albeit at lower rates, with a greater emphasis on practical gifts. Interestingly, Baby Boomers were the only generation reporting essentially no purchase regrets on Black Friday, perhaps reflecting more restrained spending. (Source: Statista’s 2023 Black Friday Purchase Regret Statistics)

By Gender

Men and women both embrace Black Friday, but men show slightly more enthusiasm for deal-hunting.

- About 73% of men say Black Friday is a great chance to score deals, vs. 67% of women. (Source: Finder’s Black Friday Statistics 2024)

- Women also show a touch more skepticism about deals: 23% of women suspect retailers inflate prices pre-Black Friday only to “discount” them later. (Source: Finder’s Black Friday Statistics 2024)

Income Levels

Black Friday draws shoppers across all income brackets, but higher earners tend to spend significantly more.

- Almost 75% of “high spenders” (often with $100k+ incomes) planned to shop online on Black Friday. (Source: Statista’s U.S. Black Friday Spending Intent Statistics 2023) It’s representing 27% of holiday shoppers but accounting for 68% of total holiday spending. (Source: Deloitte’s 2023 Holiday Retail Survey)

- These high spenders tend to be in the 27–59 age range and will shell out over $2,100 on holiday shopping on average. (Source: Deloitte’s 2023 Holiday Retail Survey)

- They are also more likely to participate in Black Friday/Cyber Monday. Meanwhile, students and younger adults with tighter budgets might be more deal-dependent or selective in their Black Friday purchases. (Source: Deloitte’s 2023 Holiday Retail Survey)

Geography & Family

- Households with kids often spend more on Black Friday. 75% of parents with children under 18 planned to purchase toys during the holidays, many of those purchases timed around Black Friday. (Source: Gallup’s 2023 Holiday Shopping Trends Survey)

Where Consumers Shop on Black Friday

Black Friday may have originated in crowded malls, but today’s consumers shop through a variety of channels. So, where do people do most of their Black Friday shopping? The data shows a decisive tilt toward online, especially via mobile, while brick-and-mortar still plays a significant role:

Online Shopping Dominates

The majority of Black Friday shoppers now favor online outlets. Convenience, wider selection, and avoiding crowds are key drivers.

- In 2024, online shoppers outnumbered in-person shoppers by about 5.6 million in the U.S. (87.3M vs. 81.7M). (Source: Search Engine Journal’s Black Friday Strategies For 2025)

- 64% of customers worldwide said they intended to shop online on Black Friday. (Source: Tidio’s 2025 Black Friday Trends Report) And U.S. data showed ~20% of shoppers were more inclined to buy online than in-store, given the choice. (Source: Capital One Shopping’s 2025 Black Friday Statistics)

- Actual behavior reflected this tilt to e-commerce: around 90 million Americans shopped online on Black Friday 2023, and that number grew further in 2024. (Source: Tidio’s 2025 Black Friday Trends Report)

In-Store Shopping Remains Strong

Black Friday has increasingly become an online-first shopping event, though physical retail remains crucial.

- 81.7 million Americans shopped in person on Black Friday, a slight increase from the previous year, indicating a rebound of in-store interest. (Source: NRF’s Thanksgiving Weekend Retail Data Release)

- 63% of shoppers go to stores to verify product quality in person and grab doorbuster deals that might be store-exclusive. (Source: Deloitte’s 2025 Holiday Retail Survey)

Mobile vs. Desktop

Within online shopping, mobile devices have become the preferred way to shop on Black Friday.

- An estimated 69% of global Black Friday e-commerce purchases were made on mobile phones, up from 68% in 2023. (Source: Salesforce’s 2024 Holiday Shopping Season Results)

- Mobile accounted for 54.5% of U.S. online holiday sales revenue in 2024. (Source: Adobe’s 2025 Holiday Shopping Forecast)

- Desktop still matters because of the higher conversion rate (6.5% vs. 3.3% on mobile); many consumers research on mobile but complete purchases on a larger screen. (Source: Statista’s 2024 Black Friday Conversion Rate Statistics)

Omnichannel shopping is common

- 28% of U.S. shoppers planned to use buy-online-pickup-in-store (BOPIS) services during 2023’s holiday sales. (Source: Deloitte’s 2023 Holiday Retail Survey)

- 71% of shoppers say they’ll use at least two channels (like buying online and picking up in store). (Source: JLL’s 2024 Retail Holiday Shopping Survey Report)

Social media and marketplace channels

- A growing number of consumers also make Black Friday purchases through social apps (Instagram, Facebook Shops) or via links from TikTok/influencers. (Source: Search Engine Land’s 2024 Holiday Season Paid Search Report)

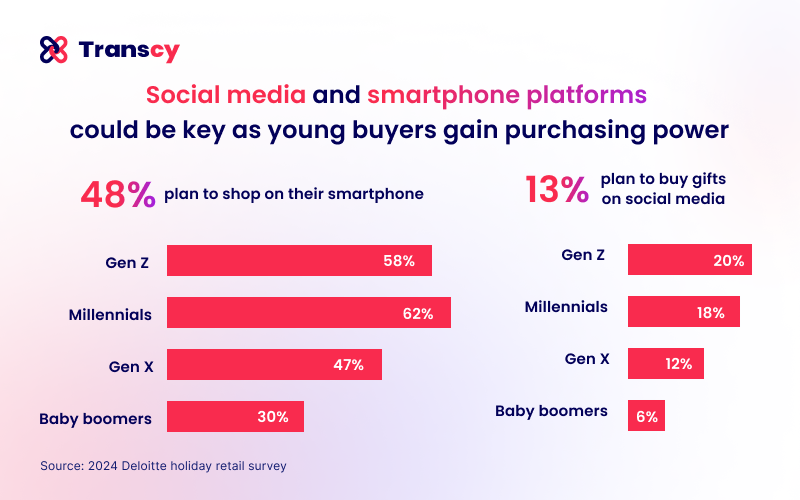

- While still a small portion, about 13% of consumers planned to buy directly through social media in the 2024 holiday season. (Source: Deloitte’s 2024 Holiday Retail Survey)

Black Friday Marketing Trends and Key Channels

In the battle for Black Friday shoppers’ attention, certain marketing channels and tactics consistently prove effective. Looking at 2024’s trends, here are the marketing strategies that stood out and will likely shape campaigns in 2025:

Email Marketing Still Reigns

Year after year, email remains the most potent marketing channel for Black Friday promotions.

- In 2024, over 61% of consumers said they prefer to hear about deals via email (far above social media or SMS). (Source: Sinch’s 2024 Black Friday Trends Report)

- Personalized Black Friday emails had ~15% higher open rates than non-personalized ones. (Source: NotifyVisitors’ 2023 Black Friday Email Statistics Report)

- Automated workflows for referrals, loyalty offers, and cart reminders yielded significant results and an ROI, with some brands seeing email-driven revenue up 82% YoY through clever workflows. (Source: Drip’s 2023 Black Friday Statistics Report)

Social Media & Influencer Impact

Short-form video was especially influential in 2024; think TikTok videos of “Black Friday hauls” and Instagram Reels showcasing deals. Many brands collaborated with influencers for Black Friday campaigns, leveraging the trust and reach of content creators.

- In 2024, Social media accounted for around 3.5% of direct online sales during the holidays. (Source: Queue-it’s 2024 Black Friday Statistics Report)

- 81% of consumers now use social media to inform their holiday purchase decisions, up significantly from the year before. (Source: JLL’s 2024 Retail Holiday Shopping Survey Report)

- TikTok’s new shopping features generated over $100 million in U.S. sales for beauty, home, and fashion products around Black Friday. (Source: TikTok’s 2024 TikTok Shop Holiday Trends Report)

- About 40% of Gen Z say influencer promos influence their holiday buys. (Source: PwC’s 2025 Holiday Outlook). And 37% of them bought something based on an influencer’s recommendation. (Source: Search Engine Land’s 2024 Holiday Season Paid Search Report)

Paid Search and SEO

Many shoppers start with a Google search for “[Brand] Black Friday deals” or “[Product] Black Friday price.” As a result, paid search ads and SEO-optimized landing pages are critical.

- According to Adobe, in holiday 2023, the largest share of U.S. online sales was driven by paid search ads (29.4% of revenue), followed by direct website visits (19.3%), affiliate/partner referrals (16.6%), organic search (15.9%), and email marketing (15.3%). (Source: Adobe’s 2024 Holiday Shopping Season Sales Report)

Site Personalization and AI

A subtler yet impactful trend in marketing involves using AI and personalization to boost conversions. Retail websites and emails employ AI to recommend products or tailor deals to each shopper’s behavior.

- In fact, 17% of all holiday season orders in 2023 were influenced by AI-powered features (product recommendations, personalized offers, chatbots, etc.). (Source: Salesforce’s 2024 Holiday Shopping Season Results)

- AI influenced an estimated $51 billion of global online sales during Cyber Week 2023 through tailored offers and chat services. (Source: Tidio’s 2025 Black Friday Trends Report)

- Retailers who deployed AI chatbots saw an average 9% lift in sales conversions. (Source: DemandSage’s 2024 Black Friday Statistics Report)

Key takeaways for businesses: Black Friday Marketing Strategy

- Omni-Channel Outreach: Don’t rely on a single channel. Combine email, SMS/push notifications, and social media to reach shoppers on all fronts. Notably, SMS/push can cut through the clutter, so integrate those for timely flash sale alerts.

- Build a strong email campaign: Plan a sequence of Black Friday emails (early sneak peeks, the big day sale, last-chance reminders). Personalize where possible (e.g., name, past products) to boost engagement.

- Optimize for mobile: Ensure your website, emails, and ads are mobile-friendly. Mobile-first design is crucial when most traffic is on phones.

- Leverage social proof and influencers: Engage influencers relevant to your niche to showcase your BF deals. Encourage user-generated content (e.g., a hashtag for customers to share their finds). This not only spreads awareness on social media but also builds trust.

- Don’t neglect SEO/SEM: Have a dedicated Black Friday landing page each year, optimized with the year and keywords, to catch search traffic. Use Google Ads for critical keywords if the budget allows. The competition is high, but so is the payoff.

- Start Early & Build Hype: Given that over half of consumers jump on early deals, launch your promotions in early November. Tease Black Friday offers weeks in advance, and consider loyalty previews or early access sales to lock in those purchases before competitors do.

- Use Personalization and AI: During the Black Friday rush, personalized product recommendations (“Recommended for you”) can increase cart sizes. If you have a chatbot, program it with Black Friday FAQs (shipping, stock levels) to handle common customer questions swiftly.

Top Product Categories and Best-Selling Items

Black Friday’s deals span virtually every retail category, but some products consistently lead the pack in sales and search interest. Here are the categories and items that dominated Black Friday 2024:

- Electronics & gadgets: Top searched items on Black Friday were dominated by tech, with big-ticket electronics (game consoles, smartphones, and TVs) drawing huge attention due to rare discounts. (Source: Printful’s 2024 Black Friday Statistics Summary)

- Toys & Games: Black Friday unofficially kicks off toy-shopping season for parents and toy collectors. In 2024, toy sales experienced a significant surge, with one report noting a 680% increase on Cyber Monday compared to October’s daily average. (Source: Adobe’s 2024 Cyber Monday Recap)

- Appliances & Home Goods: Kitchen appliances and home upgrades were hot sellers, with sales surging 464% on Cyber Monday vs. an average day. (Source: Adobe’s 2024 Cyber Monday Recap)

- Fashion & Apparel: Brands rolled out sitewide discounts to clear fall inventory and kickstart winter/holiday sales. Also, beauty products often see big sets or bundles on sale and were strong sellers, with sales up 530% vs. normal in late 2024. (Source: Adobe’s 2024 Cyber Monday Recap)

- Jewelry & Luxury: Higher-end categories like fine jewelry and luxury brands participated in Black Friday more in recent years, and consumers jumped on it. Likewise, luxury fashion brands that traditionally sat out Black Friday have started online private sales or partnered with platforms, attracting affluent deal-seekers.

Key takeaways for businesses: Product Strategy

- Stock up on expected bestsellers: Analyze last year’s sales and current trends to predict 2025’s hot items. Secure inventory early, as supply chain delays can still occur.

- Use Doorbusters Strategically: Featuring a few headline deals in top categories can drive traffic. Even if margins are lower on those, they can pull customers into your store or site, where they’ll buy other items too.

- Bundle and upsell: Leverage the traffic surge to sell accessory bundles at a slight discount. It adds value for shoppers and increases average order value.

- Don’t ignore niche categories: While electronics and toys get headlines, maybe your niche also sees a holiday spike. Understand what your customers want for Black Friday, even if it’s not in the “top 5” categories nationally, and tailor your deals accordingly.

- Keep an eye on competitors’ deals: Consumers compete fiercely in product categories. Be prepared to price-match or differentiate with bonuses (free gifts, extended warranty, etc.).

Average Discounts and Deal Types on Black Friday

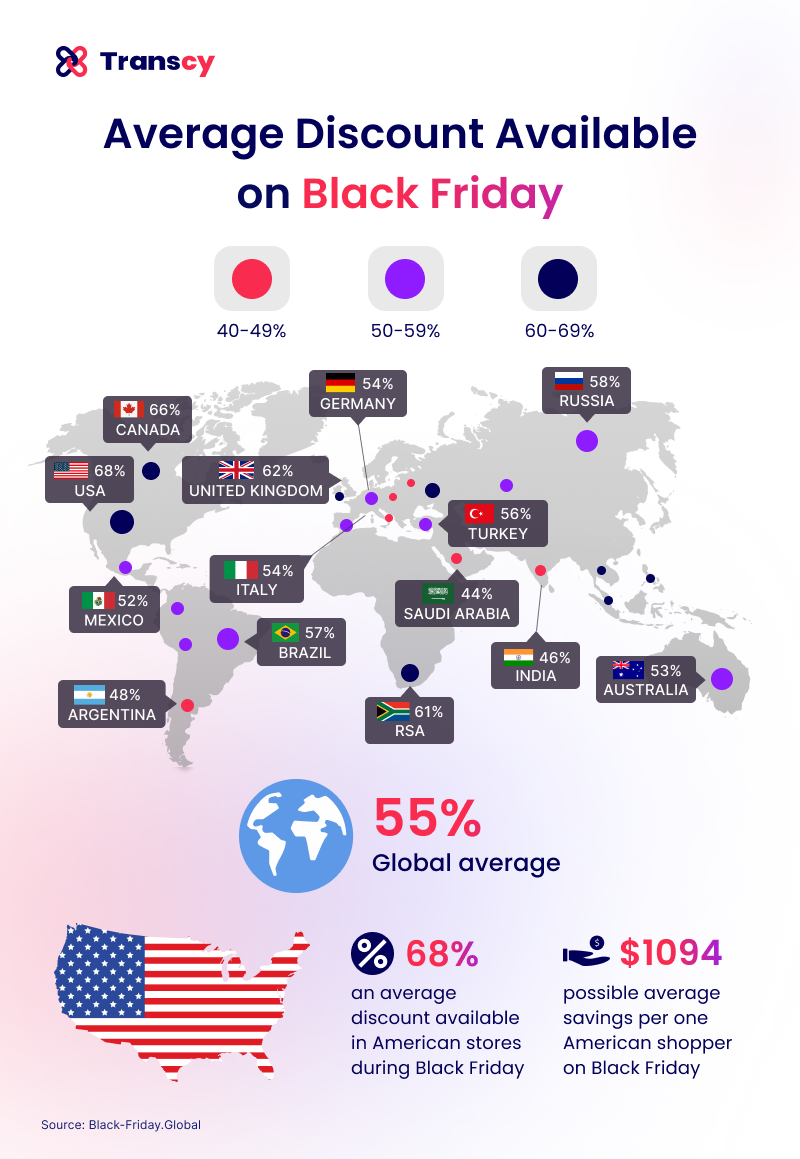

Across global markets, average Black Friday discounts typically fall between 25% and 30%. (Source: DemandSage’s 2024 Black Friday Statistics Report) The U.S. is averaging around 29–30% off during Cyber Week 2024. (Source: Adobe’s 2024 Holiday Shopping Forecast)

Apparel, accessories, and home goods often see the steepest markdowns, while high-end electronics trend lower. These figures represent the deepest discounts of the year, offering a benchmark for consumers and businesses alike.

Deal Types to Expect During Black Friday:

- Percentage-Off Discounts: The most common type, usually ranging from 20% to 50% off, depending on the category. Apparel and accessories often hit 30%+, while electronics stay closer to 10–15%. (Source: Queue-it’s 2024 Black Friday Statistics Report)

- BOGO (Buy One, Get One): Popular in apparel, beauty, and consumables. Drives higher cart size while maintaining perceived value.

- Flash Sales: Limited-time, deep discounts (sometimes hourly or daily). Designed to create urgency and spike conversions quickly.

- Coupon Codes: Often stacked on top of existing promotions and commonly used to offer an extra percentage off, gifts with purchase, or category-specific deals.

- Free Shipping Offers: A near-universal expectation: 67% of consumers won’t buy without it. Many retailers offer site-wide free shipping or tie it to cart minimums to encourage upsells. (Source: Sitecore’s 2023 U.S. Holiday Shopping Trends Report)

- Early Access & Extended Sales: Deals now start days or even weeks before Black Friday and often stretch through Cyber Monday. Loyalty members and app users frequently get first dibs.

- Gift-With-Purchase: Seen in beauty, tech, and lifestyle brands. Adds perceived value without cutting the base price.

- Doorbusters & Limited-Quantity Deals: Deep discounts on high-demand products (e.g., TVs, consoles), used to draw traffic and build urgency, though savvy consumers increasingly scrutinize their authenticity.

- Skepticism About False Discounts: Roughly 1 in 4 shoppers believe some Black Friday deals are inflated or misleading, underscoring the importance of transparent, verifiable promotions.

Regional Black Friday Highlights & Global Trends

Black Friday may have originated in the United States, but it has since evolved into a global phenomenon, with each region adding its own unique twist. Let’s look at some highlights and differences across key regions:

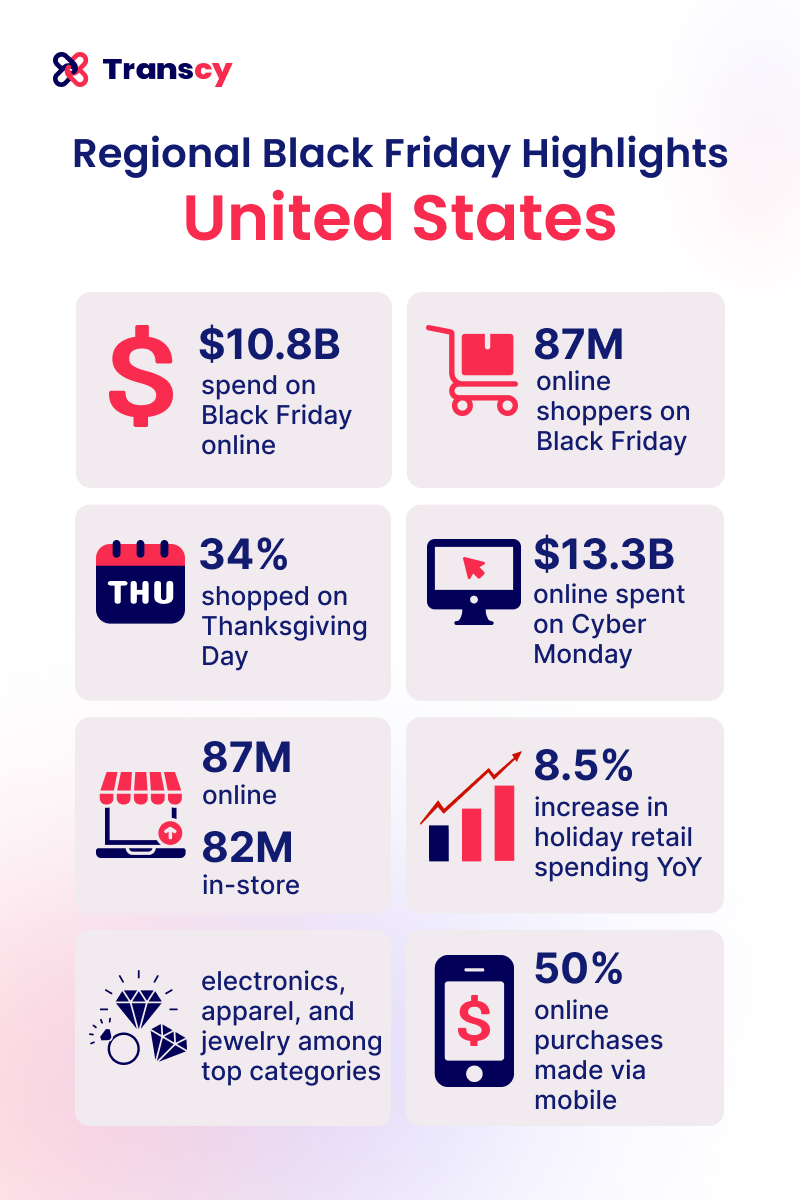

United States

- The U.S. is the epicenter of Black Friday. American consumers lead in both spending and participation, with over $10.8B spent online (Source: NPR’s BFCM record spending) and 87M online shoppers in 2024. (Source: NRF’s Thanksgiving Weekend Retail Data Release)

- Thanksgiving Day sales are now common. In 2024, 34% of U.S. shoppers shopped on Thanksgiving Day, contributing to the “Grey Thursday” phenomenon, despite backlash and some retailers opting to remain closed. (Source: Drive Research’s 2024 Black Friday Statistics)

- Cyber Monday outperformed Black Friday online. Cyber Monday 2024 reached $13.3B in online sales, ~23% higher than Black Friday, making it the biggest online shopping day in U.S. history. (Source: Adobe’s 2024 Cyber Monday Recap)

- “Cyber Five” has become a cohesive mega-event. U.S. retailers increasingly plan around the five days from Thanksgiving to Cyber Monday, with integrated strategies across all days.

- Consumers embrace omnichannel shopping. In 2024, ~87M shopped online and ~82M shopped in-store, signaling a blended retail experience. (Source: NRF’s Thanksgiving Weekend Retail Data Release)

- Retail spending continues to grow. Total holiday retail spending in Nov–Dec 2024 rose ~8.5% YoY, showing continued consumer resilience. (Source: Adobe’s 2025 Holiday Shopping Forecast)

- Electronics, toys, apparel, and jewelry dominated. Popular U.S. product categories included tech gadgets, fashion, and giftable items, per Mastercard and Adobe Analytics.

- Major retailers saw record sales volumes. Walmart generated over $1.77B, Target surpassed $500M, and Amazon marked its biggest BFCM period ever. (Source: DemandSage’s 2024 Black Friday Statistics Report)

- BNPL and mobile shopping surged. A large portion of sales was made through Buy Now, Pay Later options, and mobile accounted for over 50% of online purchases. (Source: Adobe’s 2025 Holiday Shopping Forecast)

- Logistics and labor remain pressure points. U.S. retailers focused heavily on staffing, fulfillment, and shipping speeds to meet high consumer expectations.

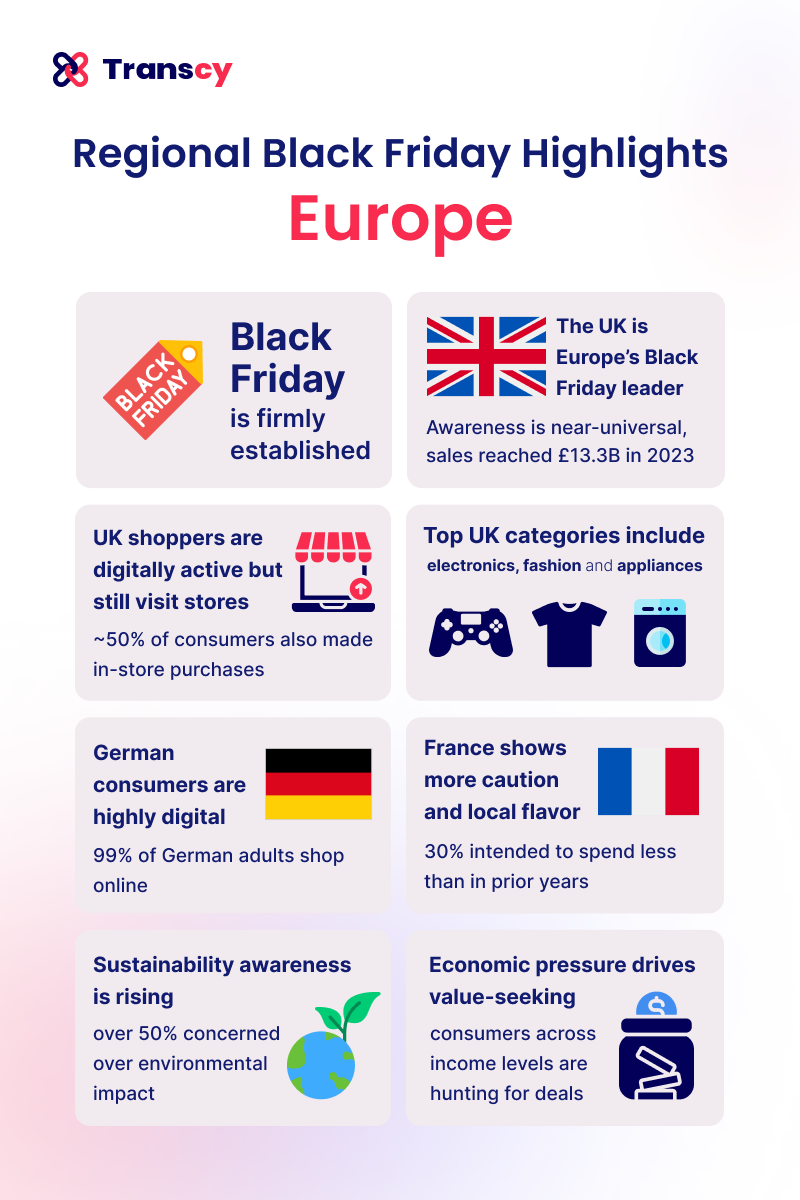

Europe

- Black Friday is firmly established across Europe. Even without Thanksgiving, European retailers have embraced Black Friday with widespread promotions and consumer participation.

- The UK is Europe’s Black Friday leader. Awareness is near-universal (0% unawareness reported), and sales reached £13.3B in 2023, up +7.6% YoY. (Source: Mintel’s 2024 Black Friday Trends and Inspiration)

- UK shoppers are digitally active but still visit stores. While online spending hit 4.6B during the BFCM weekend 2024, ~50% of consumers also made in-store purchases. (Source: DemandSage’s 2024 Black Friday Statistics Report)

- Top UK categories include electronics, fashion, and appliances. Brands like Amazon UK, Argos, Currys, and John Lewis saw strong sales, with Gen Z leading average planned spend (~£176). (Source: Statista’s 2024 U.K. Black Friday Planned Spending Data)

- German consumers are highly digital. 99% of German adults shop online (Source: Reuters’ 2024 German Online Shopping Trends), and ~80% believe the best deals are found online. Electronics and apparel are key purchase categories. (Source: Mintel’s 2024 Black Friday Trends and Inspiration)

- France shows more caution and local flavor. About 30% of French consumers intended to spend less than in prior years, and some prefer local events like “French Days” or Small Business Saturday alternatives. (Source: Statista’s 2024 Black Friday Data on European Consumers Shop Less Trend)

- Southern Europe is heavily online-first. In Italy, 70%+ of consumers said they would shop exclusively online on Black Friday (Source: Statista’s 2024 Black Friday Data on European Consumers Online Shopping) and planned to spend an average of €273. (Source: Statista’s 2024 Black Friday Data on Average Shopping Budgets in Europe)

- Electronics and fashion dominate across Europe. These remain the most searched and purchased categories, mirroring U.S. trends.

- Sustainability awareness is rising. In the UK, over 50% of shoppers expressed concern over Black Friday’s environmental impact. In Germany, nearly half prioritize sustainability when purchasing tech. (Source: Mintel’s 2024 Black Friday Trends and Inspiration)

- “Green Friday” movements gain traction. Some retailers counter Black Friday overconsumption with eco-friendly messaging, charitable donations, or sustainable product campaigns.

- “Black Week” and early deals are standard practice. Many European retailers now run extended promotions throughout November to spread demand and reduce pressure on logistics.

- Economic pressure drives value-seeking. Due to cost-of-living concerns, consumers across income levels are hunting for deals for both necessity-driven and large, planned purchases.

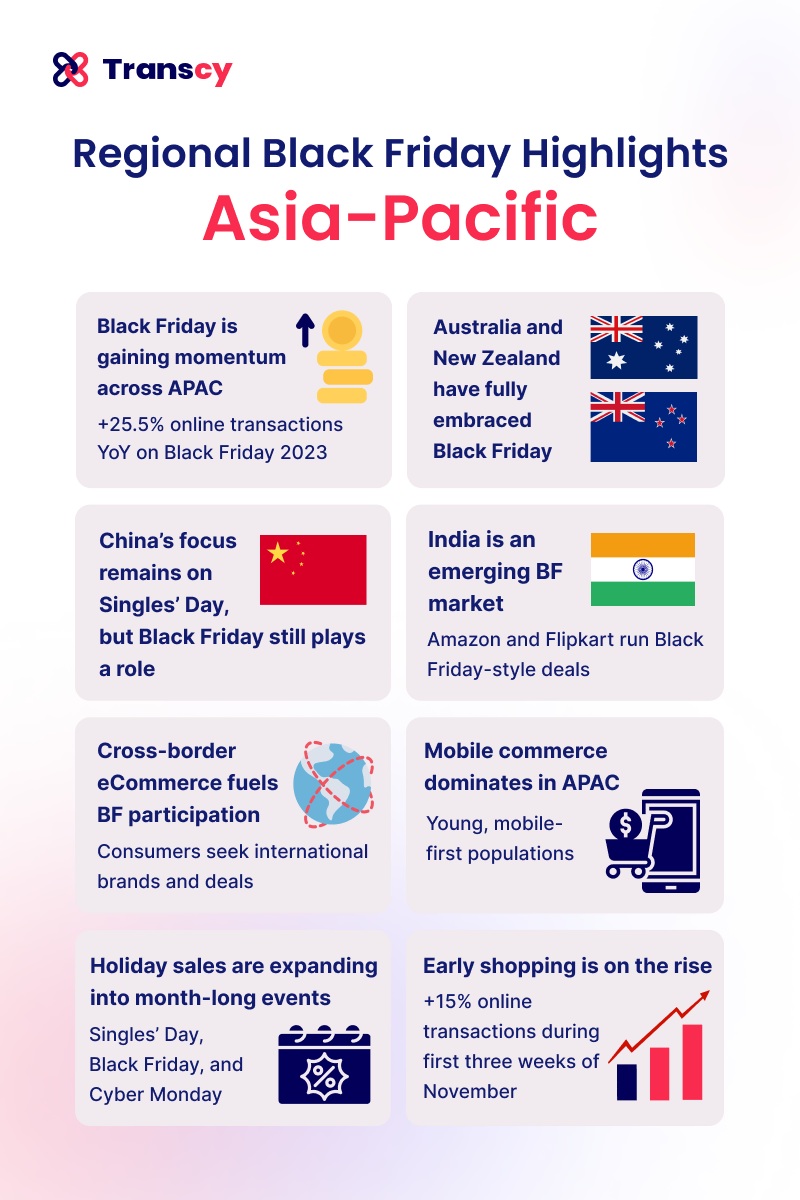

Asia-Pacific

- Black Friday is gaining momentum across APAC. Online transactions in the region surged +25.5% YoY on Black Friday 2023, the highest global growth rate. (Source: Criteo’s 2023 Black Friday Trends)

- Australia and New Zealand have fully embraced Black Friday. In 2024, online spending in Australia jumped ~30% in November compared to October, with fashion and summer apparel as the top categories. The event now rivals Boxing Day in popularity. (Source: CommBank’s November 2024 Household Spending Insights)

- Southeast Asia extends the sales season beyond Singles’ Day. Platforms like Shopee and Lazada promote Black Friday deals right after 11/11, fueling a second wave of consumer spending in November.

- Japan and Korea are slowly adopting Black Friday. While not yet culturally entrenched, Japan saw a +16% increase in online Black Friday transactions in 2023. Retailers like Aeon Mall are leading adoption. (Source: Criteo’s 2023 Black Friday Trends)

- China’s focus remains on Singles’ Day, but Black Friday still plays a role. Chinese consumers interested in Western or luxury brands engage via cross-border platforms like AliExpress and global marketplaces.

- India is an emerging Black Friday market. While Diwali remains the dominant sales season, platforms like Amazon and Flipkart run Black Friday-style deals. Average BF spending remains low (~$70/person) but is growing among urban shoppers. (Source: Moosend’s 2024 Black Friday Statistics Report)

- Mobile commerce dominates in APAC. Young, mobile-first populations across countries like India, Indonesia, and the Philippines rely heavily on apps and social media to access Black Friday offers.

- Cross-border eCommerce fuels Black Friday participation. Consumers across the region seek international brands and deals, especially where global marketplaces have a strong local presence.

- Holiday sales are expanding into month-long events. Many APAC retailers now run combined campaigns for Singles’ Day, Black Friday, and Cyber Monday, turning November into an extended online shopping season.

- Early shopping is on the rise. In 2023, APAC retailers saw a +15% boost in online transactions during the first three weeks of November, indicating growing pre–Black Friday momentum. (Source: Criteo’s 2023 Black Friday Trends)

Latin America & Others

- Brazil is a Black Friday leader in LATAM. Online transactions rose +11% in the three weeks before Black Friday 2023, and the event often breaks local sales records. (Source: Criteo’s 2023 Black Friday Trends)

- Electronics, appliances, and fashion dominate in Brazil. Despite past skepticism due to “Black Fraudes” (fake discounts), consumer trust and participation continue to grow.

- Average Black Friday spending in Brazil is ~$73. While lower than in the U.S. or Europe, it’s significant relative to local income levels and rising year-over-year. (Source: Moosend’s 2024 Black Friday Statistics Report)

- Mexico blends Black Friday with its own “El Buen Fin.” The mid-November “Good Weekend” precedes Black Friday, but U.S. Black Friday still draws strong participation, especially in border cities and online.

- Mexican shoppers favor cross-border e-commerce. Many buy from Amazon U.S. or other global platforms; average discounts reach 50%, with growing appeal among young, internet-savvy consumers. (Source: Moosend’s 2024 Black Friday Statistics Report)

- Other LATAM countries join the trend. Colombia, Argentina, and Chile see growing Black Friday engagement, with local retailers mirroring U.S. strategies.

- Africa sees rapid Black Friday growth. In South Africa, average discounts hit ~61% and average spend is ~$126 per person, driven by online merchants and major retailers. (Source: Moosend’s 2024 Black Friday Statistics Report)

- Nigeria and Kenya also embrace online Black Friday sales. Local e-commerce platforms and telcos push aggressive deals around late November.

- Middle East countries rebrand Black Friday. In the UAE and Gulf States, it’s often marketed as “White Friday” or “Yellow Friday”, but offers follow typical BFCM patterns via platforms like Amazon.ae and Noon.

- Global impact spikes in emerging markets. Compared to an average Friday, Black Friday sales jump 11,525% in Pakistan and 9,750% in Hungary, showing a huge impact despite lower baselines. (Source: Moosend’s 2024 Black Friday Statistics Report)

- Each region adapts Black Friday uniquely. Whether through local branding, trust issues, channel preferences, or sale timing, the core appeal, value, and access remain consistent.

Key takeaways for businesses: Navigating Global Black Friday

- Localize your Black Friday strategy. Adapt messaging, product positioning, and payment methods based on regional preferences, e.g., highlight sustainability in Europe, emphasize mobile-first marketing in Asia, and offer deep discounts in Latin America.

- Offer localized experiences. Use local languages (e.g., “Viernes Negro” in Spanish-speaking markets), display regional currencies, and support popular local payment options to reduce friction.

- Align campaigns with regional calendars. Consider major regional sales events such as Singles’ Day (11/11) in Asia, El Buen Fin in Mexico, and December holiday bonuses in Latin America, which influence Black Friday timing and spending.

- Adjust launch timing to local time zones. Schedule campaigns so deals go live locally in the morning, not based on U.S. midnight, for maximum visibility and performance.

- Plan for global demand, five even if U.S.-centric. Many international shoppers browse U.S. sites during Black Friday. Enable international shipping and showcase global delivery options prominently.

- Optimize logistics for international orders. Ensure your delivery timelines and policies are transparent. Consider using services like Fulfillment by Amazon (FBA) or partnering with local couriers in high-demand regions.

- Monitor regional competitors and expectations. Some markets expect steeper discounts (50–60%) or prioritize values like ethical sourcing. Understand local customer mindsets and tailor your value proposition accordingly. (Source: Moosend’s 2024 Black Friday Statistics Report)

- Adapt creatives and offers by region. For example, highlight eco-friendly products in sustainability-conscious markets and bundle savings in price-sensitive ones.

Black Friday 2025 trends & predictions to keep an eye out for

Looking ahead, Black Friday 2025 is poised to be another blockbuster, but the landscape keeps evolving. Based on current data and expert insights, here are five key trends and predictions for Black Friday 2025 that businesses should keep an eye on:

1. Continued Growth, But a Moderating Pace

Black Friday 2025 will likely set new records again, but at a more measured pace compared to the explosive double-digit growth seen during the pandemic years. Analysts forecast modest year-over-year increases, especially as the base gets larger and economic headwinds influence consumer behavior. The National Retail Federation projected a 3% rise in 2024 holiday retail sales, with similar gains expected in 2025. (Source: NRF’s 2023 Thanksgiving Weekend Shoppers Number Record)

Inflation, interest rates, and consumer caution will likely dampen excessive spending. Surveys indicate that fewer shoppers plan to spend more than they did the previous year, with only 14% intending to increase their spending in 2024. That said, the absolute dollar volume will remain massive. Retailers should expect incremental growth but face increased competition for a more cost-conscious audience. Success in 2025 will come from efficient execution, not overreliance on sheer volume. (Source: Gartner’s 2024 Holiday Early Shopping Trends Survey)

2. Online, Mobile, and Social Commerce Lead the Way

Digital commerce will dominate Black Friday 2025. Online shopping is set to capture a larger share of sales globally, with mobile commerce leading the charge. In 2024, nearly 69% of online Black Friday purchases were made on mobile devices; that figure could reach 70–75% in 2025. (Source: Salesforce’s 2024 Cyber Week Shopping Insights Report)

Social commerce will also expand. Platforms like TikTok, Instagram, and Facebook are refining shopping features, enabling in-app purchases and livestream selling. Consumers will increasingly shop directly through influencers and real-time events. Meanwhile, physical stores will maintain relevance, but foot traffic may level off. Hybrid formats like click-and-collect and curbside pickup will remain essential. Retailers must double down on mobile optimization and social selling to capture the modern shopper.

3. The Rise of “Black November”

The Black Friday calendar has extended beyond a single day. By 2025, we expect an even stronger shift toward “Black November,” with sales starting as early as late October. Major retailers are already launching multi-week promotional campaigns to spread out demand, ease fulfillment pressure, and secure early consumer dollars.

This expanded timeline helps consumers budget more strategically and allows retailers to test and rotate offers. Cyber Monday has also grown into a week-long event, blurring the lines between sale days. For 2025, brands should structure their campaigns to maintain engagement across the month, using phased deal drops and personalized incentives to sustain momentum.

4. Value-Driven, Deal-Focused Shopping Intensifies

Economic caution remains a key consumer sentiment, fueling a hunt for maximum value. The inflationary environment of recent years has trained shoppers to scrutinize pricing and prioritize essential or high-utility purchases. In 2023, 66% of shoppers cited rising prices as their motivation for participating in Black Friday. (Source: Deloitte’s 2023 Holiday Retail Survey)

Retailers should expect shoppers to use comparison tools, browser extensions, and deal aggregators more than ever. Discounts, loyalty rewards, and bundled savings will be powerful incentives. Additionally, many consumers will avoid debt, preferring budget-conscious buys. Price alone won’t guarantee success. Shoppers want quality and utility, too. Expect fierce competition on both perceived and actual value.

5. Smarter, More Digital Marketing Strategies

Marketing in 2025 will be data-driven, AI-powered, and hyper-personalized. Retailers will use AI to optimize ad targeting, personalize email campaigns, and adjust pricing dynamically in real time. In 2024, AI influenced an estimated $51B in global online Cyber Week sales. That number is set to grow. (Source: Salesforce’s 2023 Cyber Week Sales Performance Report)

Chatbots, virtual assistants, and AI-generated content will handle large portions of customer interaction, especially during peak traffic. First-party data and loyalty programs will gain importance, helping retailers deliver curated offers to high-value segments. Expect more brands to experiment with interactive formats like AR product previews, app-based scavenger hunts, and real-time quizzes to drive conversions. Precision, personalization, and omnichannel fluidity will define the most successful Black Friday campaigns.

Conclusion

Black Friday has evolved from chaotic store lines into a global, data-driven shopping phenomenon. The 2024 numbers tell the story: record-setting online sales, growing international participation, and consumers embracing mobile, early promotions, and smarter shopping tools. As we look to 2025, it’s clear that shoppers will expect more: better value, seamless digital experiences, and meaningful engagement across channels.

For businesses, success will hinge on agility, digital readiness, and a deep understanding of shifting consumer behaviors. With the right strategy and early planning, Black Friday 2025 offers a powerful opportunity to win both sales and loyalty in a hyper-competitive landscape.

Table of Contents

Read more articles

"I'm Alexandre Le - a marketer with 5+ years of hands-on experience in the eCommerce industry. I want to use my expertise and personal perspectives to produce insightful blog posts that help online store owners to launch, run, and scale up their businesses successfully."