Table of Contents

💡 TL;DR What to do: Set up a reliable system to handle international taxes and duties before Q4. Why it matters: Avoid surprise fees, build trust, and ensure smooth holiday deliveries. How to start: Choose your solution (Markets Pro, app, or Global-e) → classify products → test orders early. |

As a Shopify store owner, the holiday season brings plenty of opportunities, but it also brings a unique set of challenges – particularly when it comes to international taxes and duties.

Nothing destroys customer trust faster than a surprise COD (Cash on Delivery) bill from customs, and nothing creates more holiday season chaos than a flood of packages stuck at the border.

This isn’t just a tax problem; it’s a customer experience and operational survival issue. If you want to sell internationally with confidence this Q4, you need a clear plan for handling taxes and duties.

In this guide, we’ll break down everything you need to know and provide actionable steps to ensure you’re ready for a smooth holiday season.

1. The glossary: Demystifying the jargon in plain English

Before diving into strategies, let’s clear up some key terms that might be confusing. These are essential concepts for understanding how international taxes and duties work and why they matter.

Landed Cost

This is the total cost of delivering a product to the customer’s door, including the product price, shipping, taxes, and duties. Essentially, it’s what the customer pays in total when buying from your store.

DDP (Delivered Duty Paid)

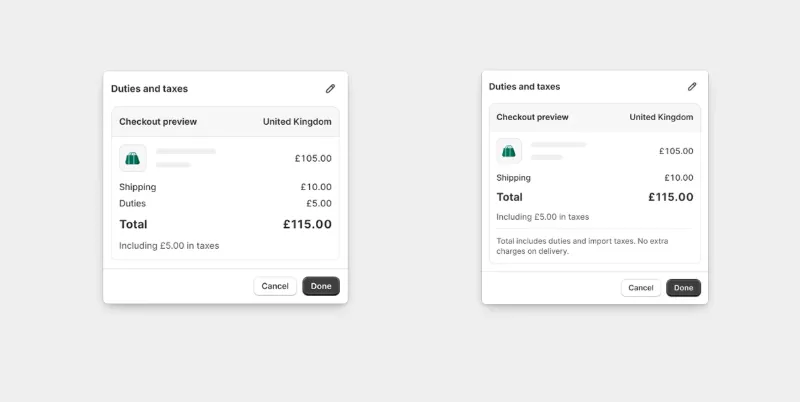

This is a good way of handling taxes and duties. With DDP, you collect all duties and taxes upfront at checkout. The customer knows exactly what they’re paying, and there are no surprises when the package arrives. This approach leads to higher customer satisfaction and fewer abandoned carts.

DDU (Delivered Duty Unpaid)

This is the bad way – and one you want to avoid at all costs. With DDU, the customer receives their package, but then they get an unexpected bill from customs for duties and taxes. This creates frustration, refused packages, and higher chargebacks, resulting in a terrible customer experience.

HS Codes (Harmonized System Codes)

These are the Harmonized System Codes that identify products for customs purposes. You need to classify your products with the correct HS codes to avoid delays and fines. These codes are used to determine the correct duties and taxes for each product based on its category and country of origin.

2. The core strategy: The three paths to handling duties on Shopify

Now that we’ve covered the basic terminology, let’s explore your options for handling duties on Shopify. You have three main paths to choose from:

Path 1: The native solution (Shopify Markets Pro)

What it does: Shopify’s Markets Pro is your “easy button” for DDP. It automatically calculates and collects duties and remits them for you during checkout. This is an integrated solution within Shopify that streamlines your global sales operations.

Best for: Shopify stores that want an easy, integrated solution for handling duties and taxes, especially for small to medium-sized businesses looking to expand internationally without worrying about the complexities of manual calculations.

What it costs: Instead of a monthly fee, Shopify Markets Pro charges a single fee per international transaction that covers payment processing and all the complexities of duties and taxes.

For example, for US-based stores, this fee is currently 6.5% of the total order value. Be sure to factor this into your international pricing to protect your margins.

Why it works: Shopify’s built-in solution is easy to set up, transparent, and reliable, allowing you to focus on selling while Shopify takes care of the rest.

Path 2: The third-party app solution (Advanced control)

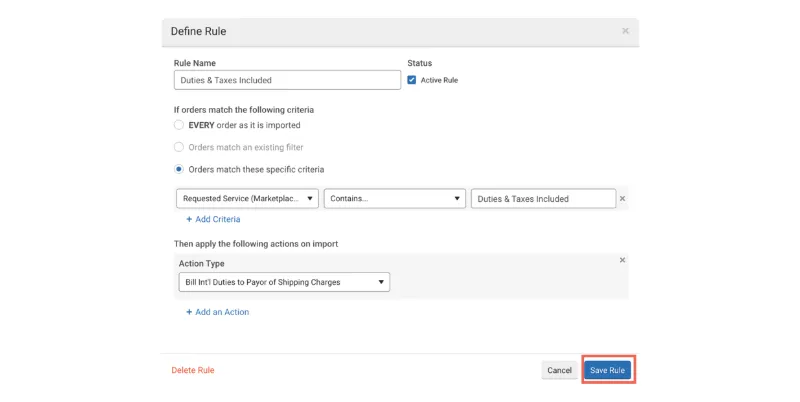

What it does: If you need more customization or want to use shipping carriers that aren’t supported by Shopify Markets Pro, you may need a third-party app like Zonos.

Best for: Merchants who need advanced control over their checkout process or need to work with non-standard shipping carriers.

For example, if you want to offer more granular control over duties, such as creating custom rules to subsidize duties on specific products to be more competitive in a certain market, Zonos can give you that.

Why it works: This solution allows you to maintain flexibility and customization while still collecting taxes and duties upfront. However, it requires more manual setup and ongoing management compared to Shopify Markets Pro.

Path 3: The enterprise solution (Fully managed)

What it does: For enterprise-level brands with complex international operations, platforms like Global-e provide a fully managed solution. They handle everything from taxes and duties to local payment methods and customs compliance.

Best for: Large Shopify stores that have significant international sales and want to outsource all of their international operations, including the complexities of handling taxes and duties.

Why it works: This solution is ideal for brands that want to scale globally without worrying about the operational complexities involved in managing taxes, duties, and local payment methods. Global-e takes care of everything, allowing you to focus on growing your brand.

3. The action plan: Your Q4 international tax & duty checklist

With the holiday season fast approaching, it’s time to get actionable. Here’s a checklist to ensure you’re prepared for a hassle-free Q4:

July

✅ Choose your path (Markets Pro vs. Third-Party App) and get it set up.

✅ Decide which solution will work best for your business, and get it integrated into your Shopify store. Don’t wait until November to figure this out.

August

✅ Classify your top-selling products with the correct HS codes.

✅ This is a task that’s easy to overlook, but if you’re selling internationally, it’s essential. Make sure all your products are correctly classified to avoid customs delays.

September

✅ Update your Shipping Policy page to clearly market that all duties and taxes are included at checkout.

✅ Make this a trust-building feature on your website. Customers will appreciate the clarity, and it will reduce confusion and complaints later.

✅ Make sure to also communicate this change in your marketing emails.

October

✅ Place a test order for your top 3 international countries to ensure the landed cost calculation is working perfectly before BFCM starts.

✅ Test orders are a great way to ensure everything works smoothly.

✅ This will help you catch any potential issues in advance and make sure there are no surprises during the holiday rush.

Conclusion

Handling international taxes and duties doesn’t have to be a daunting task. With the right tools and a clear strategy, you can ensure that your customers have a seamless shopping experience while avoiding the chaos of surprise charges and border delays. The key is to set up your system now – not during the holiday rush – and ensure your international sales are smooth, transparent, and profitable.

Now is the time to audit your store, choose the right path for your business, and get your international tax and duty strategy in place. This Q4, sell internationally with confidence.